Unlocking a $200m market potential -

Revolutionizing financial reconciliation

UX Research

FinTech

Market Expansion

About the client

Nanonets is an AI-powered platform that automates data extraction from financial documents to reduce manual work.

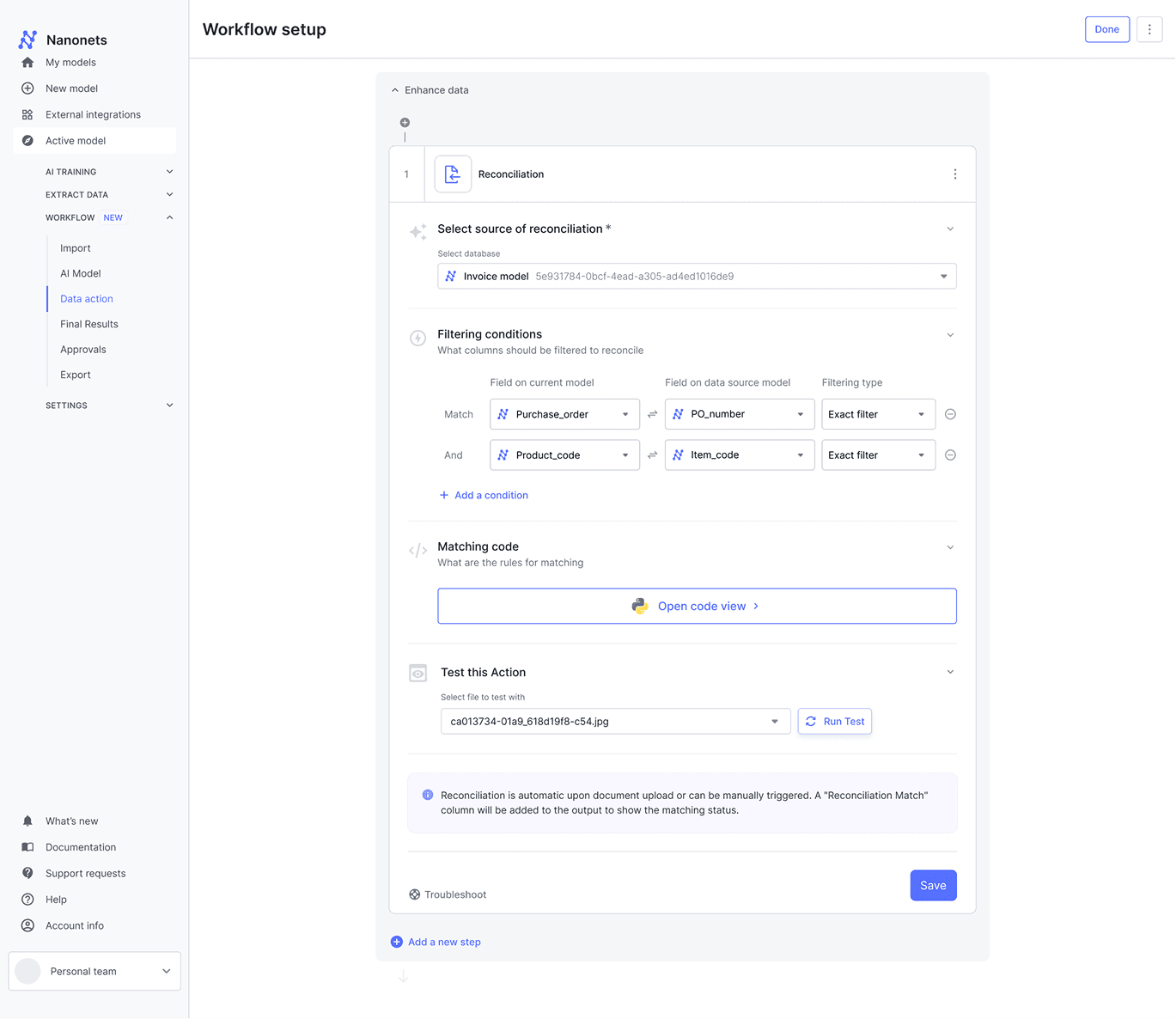

We built a reconciliation solution combining document extraction and AI to streamline tedious financial processes.

Goal

Design an AI-driven reconciliation experience to simplify workflows, accelerate growth, and challenge dominant incumbents like QuickBooks, Xero, Oracle, and BlackLine.

Responsibilities & duration

User research, usability testing, user flows, wireframes, prototyping, and impact tracking.

12 weeks

As reconciliation was a new domain for the team, we lacked a deep understanding of the specific requirements and challenges associated with the reconciliation process. To bridge this knowledge gap and gain valuable insights into the process, its pain points, and market gaps, we initiated a series of expert interviews. These interviews helped us understand the complexities of existing solutions, and identify areas where there was a clear opportunity to improve the user experience and streamline the process.

Automate Transaction Matching

Automatically match bank and ERP transactions from CSVs to remove manual reconciliation.

Extract Data from Physical Documents

Capture and structure data from paper records for direct comparison with digital files

Simplify Card Reconciliation

Manage variable fees and charge structures with accurate, automated workflows.

Handle Complex Reconciliation

Support many-to-one and rule-based matching beyond typical ERP limitations.

Challenges

The AI-driven reconciliation market was still emerging, with few established competitors and limited publicly available information. Most traditional tools were only accessible via sales demos, making direct feature comparisons difficult, so we relied on customer insights to understand key pain points.

An Iterative Approach

To address limited competitor insights, we adopted an iterative approach—rapidly prototyping and gathering feedback from early users. This helped us uncover key needs and refine the feature despite the lack of extensive market data.

Lack of Visualization

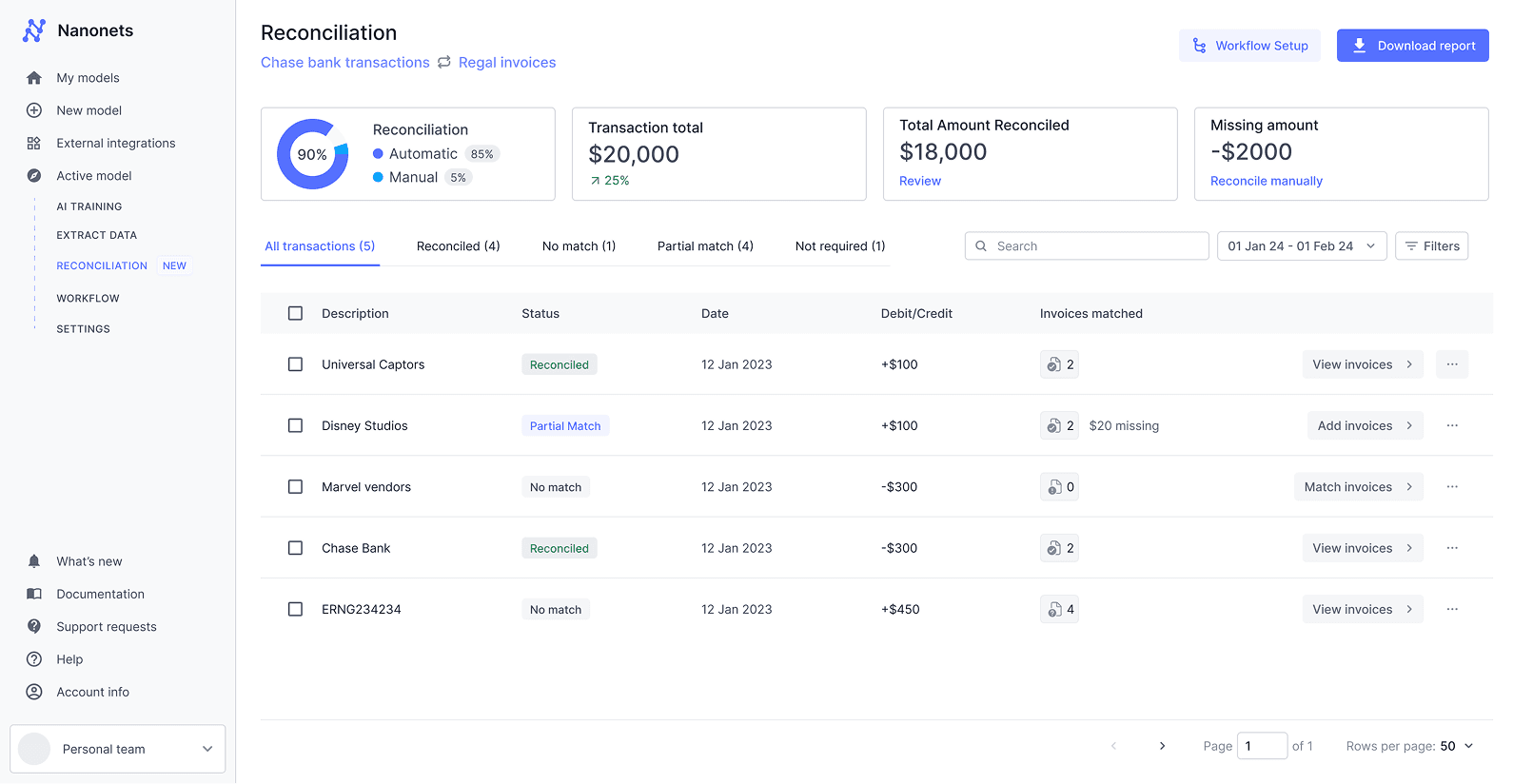

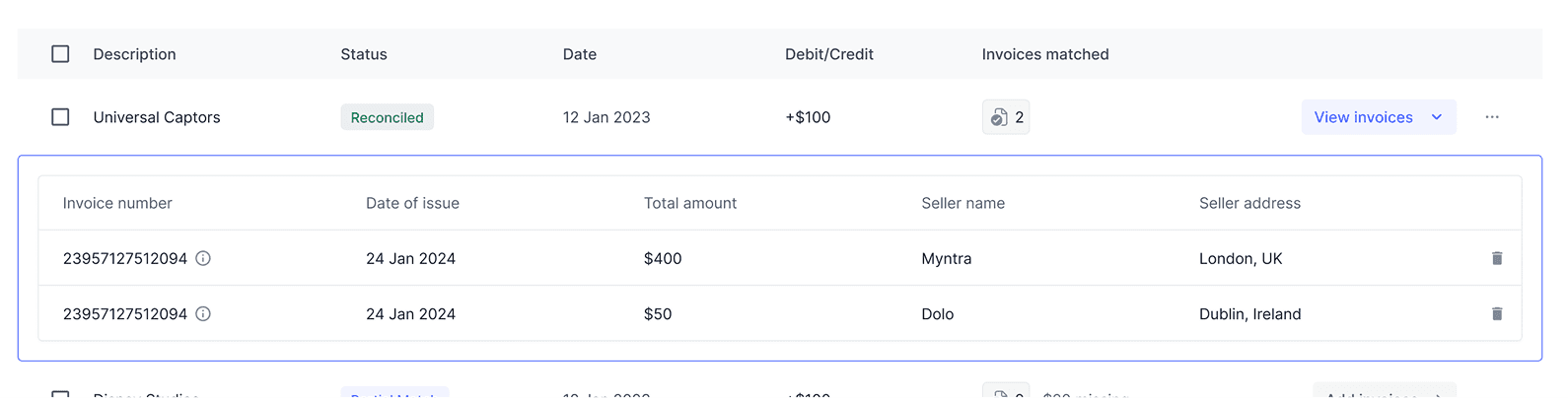

Users wanted clearer visual mapping between invoices and bank statements

Manual Verification

Despite automation, users needed the ability to review and correct mismatches.

Transaction Marking

Users requested an option to tag transactions as “reconciliation not required.”

Impact

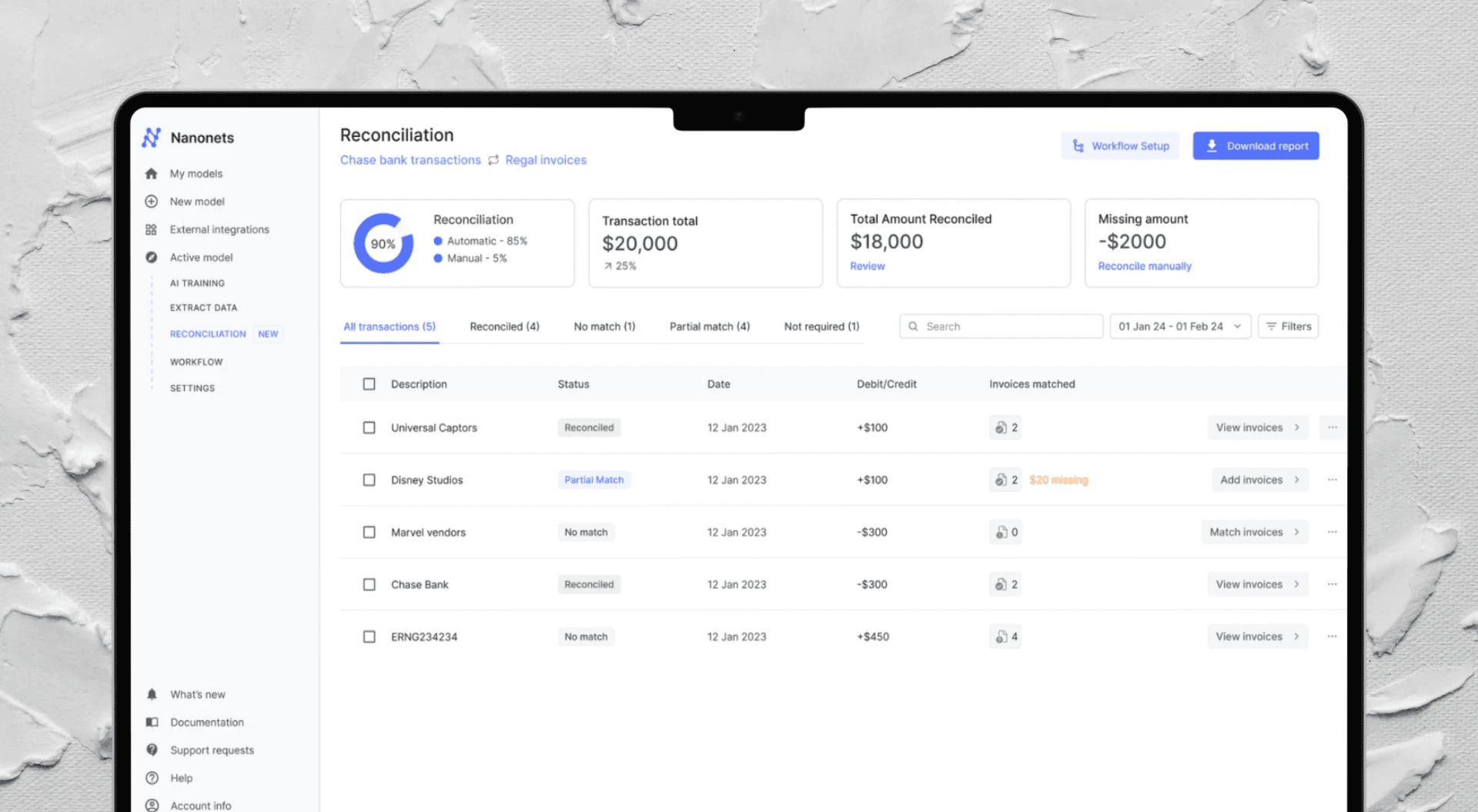

By acting on user feedback and improving visibility, visualization, and control, adoption of the reconciliation solution increased. Over 14 customers adopted the feature, contributing to a 12% ARR increase. We automated 95%+ of the process and reduced financial close time by 70%.

Reflection

User empathy guided this project, especially without the resources for a full competitive audit. I learned to rely on iterative design, using session recordings and usability tests to improve continuously.

Setting clear metrics helped me measure impact and spot opportunities, while aligning product and business goals kept the work focused. I also realized the value of building a deep understanding of the domain to design more effective solutions.